Percentage taken out of paycheck

Simplify Your Day-to-Day With The Best Payroll Services. However they dont include all taxes related to payroll.

Paycheck To Paycheck Budget Printable Zero Based Budget Etsy Budgeting Budget Template Budget Printables

You pay the tax on only the first 147000 of your earnings in 2022.

. Without the help of a paycheck calculator its tricky to figure out what your take-home pay will be after taxes and other monies are withheld. How do I calculate salary to hourly wage. For Medicare taxes 145 is deducted from each.

The most common pre-tax contributions are for retirement accounts such as a 401k or 403b. Many cities and villages in Ohio levy their own municipal income taxes. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year.

The size of your paycheck will depend of course on your salary or wages. Estimate your federal income tax withholding. But it will also depend on your marital status your pay frequency and any.

FICA taxes are commonly called the payroll tax. How Your Pennsylvania Paycheck Works. CHIP is a program specifically targeted at providing health coverage for children.

What is the percentage that is taken out of a paycheck. In fact 848 municipalities have their own income taxes. If you have health or life insurance plans through your.

The current tax rate for social security is 62 for the employer and 62 for the employee or 124 total. What percentage of taxes are taken out of payroll. How Your Massachusetts Paycheck Works.

Use this tool to. These are contributions that you make before any taxes are withheld from your paycheck. Since 142800 divided by 6885 is 207 this threshold is reached after the 21st paycheck.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. FICA taxes consist of Social Security and Medicare taxes. For the first 20 pay periods therefore the total FICA tax withholding is equal to or.

For example if an employee earns 1500. Other money deducted from your paycheck depends on whether you opt to take advantage of benefits offered by your employer. Divide this number by the gross pay to determine the percentage of taxes taken out of a paycheck.

The current rate for. The amount of FICA taxes withheld will vary because its not a set amount but a percentage of. You only pay taxes on contributions and earnings when the money is withdrawn.

Social Security tax. How to calculate annual income. This is divided up so that both employer and employee pay 62 each.

Any income exceeding that amount will not be taxed. The current tax rate for social security is 62 for the employer and 62 for the employee or 124 total. Your employer will withhold money from each of.

The federal government requires that you pay 62 percent of your gross pay for FICA taxes and one-half of your Medicare taxes. For the 2019 tax year the maximum. Your 401k plan account might be your best tool for creating a secure retirement.

Multiply the hourly wage by the number of. On the state level you can claim allowances for Illinois state income taxes on Form IL-W-4. See how your refund take-home pay or tax due are affected by withholding amount.

Ad Compare and Find the Best Paycheck Software in the Industry. The employer portion is 15 percent and the. There is a wage base limit on this tax.

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Pin On My Saves

:max_bytes(150000):strip_icc()/Paycheck_AdobeStock_154492502_Editorial_Use_Only-b62ac70013ec4e13b3e2a73be5e9c239.jpeg)

Gtl Group Term Life On A Paycheck

Sample Pay Check And Fica Taxes Savings For Cpt Opt Studetns

What Everything On Your Pay Stub Means Money

A Guide On How To Read Your Pay Stub Accupay Systems

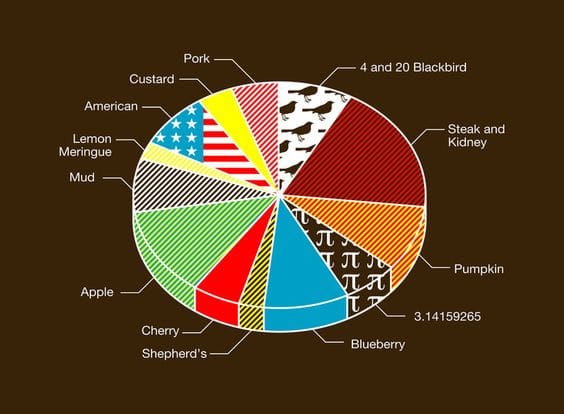

The Measure Of A Plan

Free Printable Paycheck Stub Templates Pay Template Canada Inside Free Pay Stub Template Word Cumed O Word Template Payroll Template Templates Printable Free

Budget Percentages How To Spend Your Money Budgeting Budget Percentages Budgeting Money

What Exactly Gets Taken Out Of Your Paycheck Tax Deductions Paycheck Payroll

Decoding Your Paystub In 2022 Entertainment Partners

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Paycheck Calculator Online For Per Pay Period Create W 4

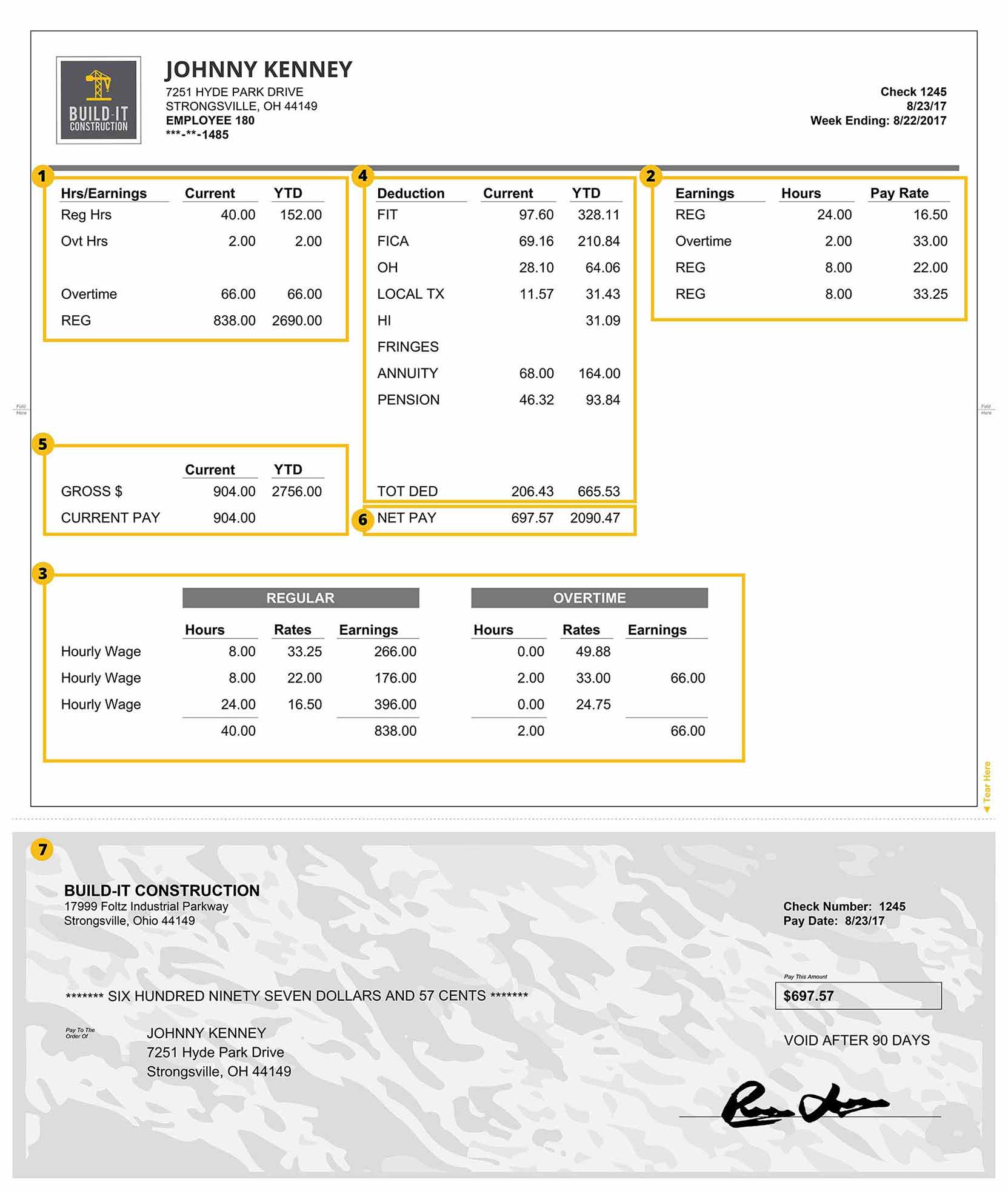

A Construction Pay Stub Explained Payroll4construction Com

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Understanding Your Paycheck Credit Com

Understanding Your Paycheck